The Significance of Social Security Numbers in Employment: A Comprehensive Overview

Related Articles: The Significance of Social Security Numbers in Employment: A Comprehensive Overview

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Significance of Social Security Numbers in Employment: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Significance of Social Security Numbers in Employment: A Comprehensive Overview

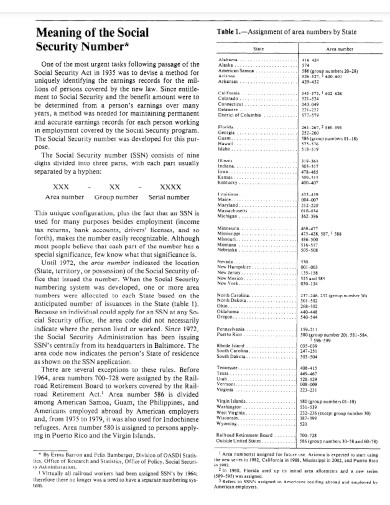

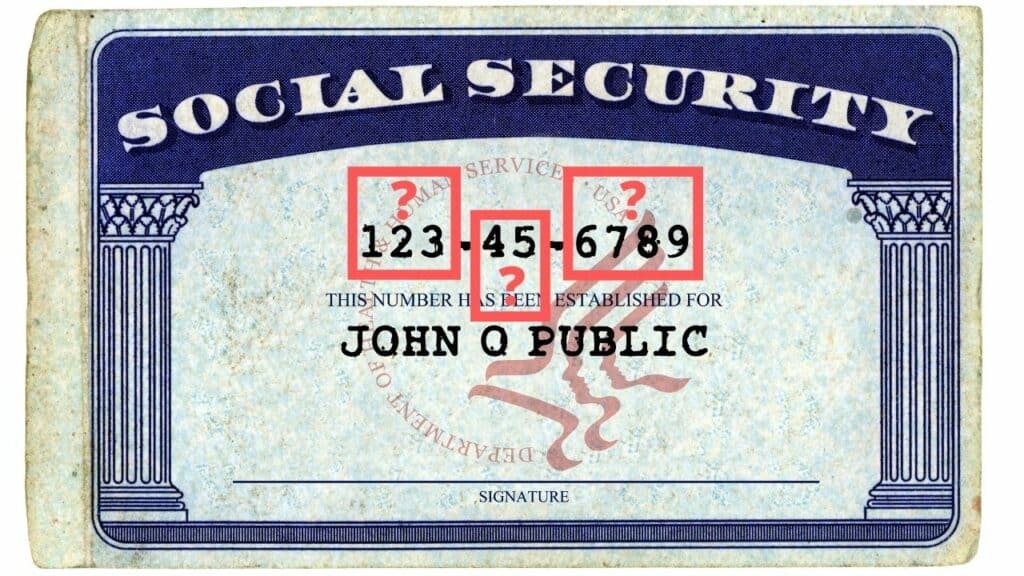

The Social Security Number (SSN) is a nine-digit number issued by the Social Security Administration (SSA) to every individual in the United States. While primarily associated with retirement benefits, the SSN has evolved into a crucial identifier for various aspects of modern life, including employment. This article delves into the reasons why employers request SSNs, the benefits associated with this practice, and the legal framework surrounding its use.

The Rationale Behind Requesting SSNs

Employers require SSNs for a multitude of reasons, each contributing to the smooth functioning of the employment ecosystem:

- Taxation and Withholding: The most fundamental reason for requesting SSNs is to facilitate accurate tax reporting and withholding. Employers are legally obligated to withhold taxes from employee wages and remit them to the government. The SSN serves as the primary identifier for matching employee earnings with tax obligations.

- Payroll Processing and Direct Deposit: SSNs are essential for payroll processing and direct deposit. Employers use SSNs to ensure that wages are deposited into the correct bank accounts, minimizing errors and ensuring timely payments.

- Employee Identification and Verification: SSNs serve as a unique identifier for each employee, enabling employers to distinguish between individuals and prevent fraud. They are used to verify an employee’s identity and confirm their eligibility for employment.

- Government Reporting and Compliance: Employers are required to report employee information to various government agencies, including the SSA and the Internal Revenue Service (IRS). SSNs are crucial for fulfilling these reporting requirements and ensuring compliance with federal and state laws.

- Employee Benefits Administration: SSNs are used to administer employee benefits, such as health insurance, retirement plans, and disability insurance. They help in tracking employee contributions, benefit eligibility, and claim processing.

- Background Checks and Employment Verification: Employers may use SSNs to conduct background checks and verify employment history. This practice helps ensure that potential employees are who they claim to be and have a clean record.

Benefits of Using SSNs in Employment

The use of SSNs in employment offers several benefits, both for employers and employees:

- Accurate Tax Reporting and Compliance: SSNs enable accurate tax reporting and withholding, ensuring that employees pay the correct amount of taxes and that employers fulfill their legal obligations.

- Efficient Payroll Processing and Direct Deposit: SSNs streamline payroll processing and direct deposit, ensuring timely and accurate payments to employees.

- Reduced Fraud and Identity Theft: SSNs help prevent fraud and identity theft by providing a unique identifier for each employee.

- Enhanced Employee Security and Benefits: SSNs facilitate the administration of employee benefits, ensuring that employees receive the benefits they are entitled to.

- Improved Employment Verification and Background Checks: SSNs contribute to thorough background checks and employment verification, enhancing the security and reliability of the hiring process.

Legal Framework and Privacy Considerations

The use of SSNs in employment is governed by a complex web of federal and state laws, including the Fair Credit Reporting Act (FCRA), the Privacy Act of 1974, and various state data privacy laws. Employers are required to obtain consent from employees before using their SSNs for background checks and other purposes. They must also comply with strict guidelines regarding the storage, use, and disclosure of SSNs.

FAQs Regarding the Use of SSNs in Employment

Q: When should an employer ask for an SSN?

A: Employers should request an SSN only after a conditional offer of employment has been made and the candidate has accepted. This ensures that the request for an SSN is justified and complies with legal requirements.

Q: What should an employer do if an employee refuses to provide an SSN?

A: Refusal to provide an SSN may raise concerns about an individual’s legal status or eligibility for employment. Employers should carefully review the situation and explore alternative options, such as verifying the employee’s identity through other means.

Q: Is it legal for an employer to use an employee’s SSN for purposes other than payroll and tax reporting?

A: Generally, employers are prohibited from using an employee’s SSN for purposes other than payroll, tax reporting, and other legitimate business reasons. The use of SSNs for unauthorized purposes can violate privacy laws and result in legal consequences.

Q: How should employers protect employee SSNs from unauthorized access and disclosure?

A: Employers have a legal obligation to protect employee SSNs from unauthorized access and disclosure. This includes implementing robust security measures, such as encryption, access controls, and secure data storage practices.

Tips for Employers Regarding the Use of SSNs

- Obtain informed consent: Employers should obtain informed consent from employees before using their SSNs for any purpose. This consent should be in writing and clearly explain the intended use of the SSN.

- Use SSNs only for legitimate business purposes: Employers should restrict the use of SSNs to legitimate business purposes, such as payroll, tax reporting, and employee benefits administration.

- Implement robust security measures: Employers should implement robust security measures to protect employee SSNs from unauthorized access and disclosure.

- Train employees on data privacy: Employers should train employees on the importance of data privacy and the proper handling of sensitive information, including SSNs.

- Stay informed about legal requirements: Employers should stay informed about federal and state laws regarding the use of SSNs in employment and ensure compliance with all applicable regulations.

Conclusion

The use of SSNs in employment is a complex and multifaceted issue with significant legal and ethical implications. Employers must understand the rationale behind requesting SSNs, the benefits associated with their use, and the legal framework surrounding their collection and storage. By adhering to legal requirements, implementing robust security measures, and prioritizing data privacy, employers can ensure the responsible and ethical use of SSNs in the employment process, fostering trust and transparency in the workplace.

Closure

Thus, we hope this article has provided valuable insights into The Significance of Social Security Numbers in Employment: A Comprehensive Overview. We appreciate your attention to our article. See you in our next article!