Navigating the World of Online Credit: A Comprehensive Guide

Related Articles: Navigating the World of Online Credit: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the World of Online Credit: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Online Credit: A Comprehensive Guide

The digital age has revolutionized the way we access and manage finances. Online credit has emerged as a convenient and accessible option for individuals seeking financial assistance. This guide aims to provide a comprehensive understanding of online credit, its benefits, and the critical considerations involved in obtaining it.

Understanding Online Credit:

Online credit refers to any form of credit accessed and managed through digital platforms. This encompasses a wide range of financial products, including:

- Personal Loans: Unsecured loans offered for various purposes, such as debt consolidation, home improvements, or medical expenses.

- Credit Cards: Plastic cards that allow individuals to borrow money for purchases and pay it back over time.

- Payday Loans: Short-term loans designed to provide quick cash advances, often with high interest rates.

- Lines of Credit: Flexible credit options that allow individuals to borrow money as needed, up to a pre-approved limit.

- Peer-to-Peer Lending: Loans facilitated through online platforms that connect borrowers with individual investors.

Benefits of Online Credit:

Online credit offers numerous advantages over traditional lending methods, making it an attractive option for many:

- Convenience: Applying for credit, managing accounts, and making payments can all be done from the comfort of one’s home, eliminating the need for physical visits to financial institutions.

- Accessibility: Online platforms often have less stringent eligibility requirements compared to traditional lenders, making credit more accessible to a wider range of individuals.

- Speed: The application and approval processes for online credit are typically faster than traditional methods, allowing individuals to access funds more quickly.

- Transparency: Online lenders often provide clear and transparent information about loan terms, interest rates, and fees, empowering borrowers to make informed decisions.

- Flexibility: Online platforms often offer a variety of loan options and repayment terms, catering to individual needs and financial situations.

Navigating the Online Credit Landscape:

While online credit offers numerous benefits, it is crucial to approach it with caution and diligence. Here are some key considerations:

- Interest Rates: Online lenders often have higher interest rates compared to traditional lenders. It is essential to compare interest rates from multiple lenders before making a decision.

- Fees: Online credit products often come with various fees, such as origination fees, late payment fees, and annual fees. Carefully review these fees before committing to a loan.

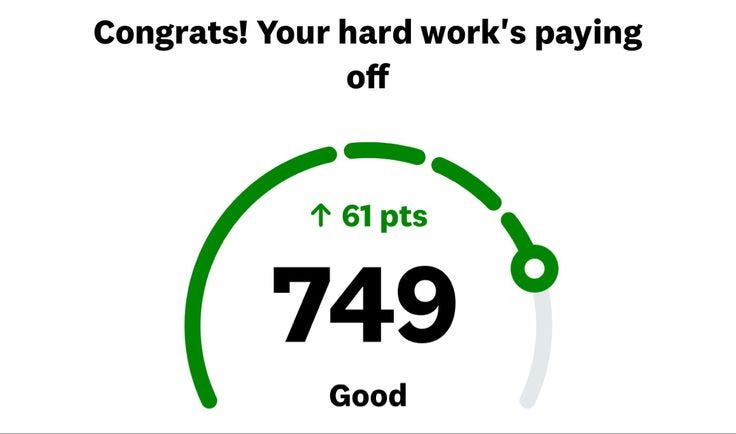

- Credit Score: Online lenders typically use credit scores to assess creditworthiness and determine interest rates and loan terms. Maintaining a good credit score is essential for securing favorable loan offers.

- Loan Terms: Pay close attention to the loan terms, including the repayment period, interest rate, and any associated fees. Ensure that the terms are manageable and align with your financial goals.

- Lender Reputation: Research the reputation of online lenders before applying for credit. Look for reviews and ratings from other borrowers to gauge the lender’s trustworthiness and customer service.

Tips for Obtaining Online Credit:

- Check Your Credit Score: Before applying for online credit, review your credit score and address any issues that may affect your eligibility or interest rate.

- Compare Offers: Obtain quotes from multiple lenders to compare interest rates, fees, and loan terms.

- Understand the Terms: Read the loan agreement carefully before accepting any offer. Ensure that you understand all the terms and conditions.

- Budget Wisely: Only borrow what you can afford to repay. Consider your income, expenses, and existing debt obligations when determining the loan amount.

- Make Timely Payments: Timely repayments are crucial for building a strong credit history and securing favorable loan offers in the future.

FAQs about Online Credit:

Q: Is online credit safe?

A: Online credit can be safe if you take precautions. Choose reputable lenders, verify their legitimacy, and ensure the security of your personal and financial information.

Q: What is the minimum credit score required for online credit?

A: The minimum credit score required varies depending on the lender and the specific credit product. Generally, a higher credit score improves your chances of approval and secures lower interest rates.

Q: How can I avoid high interest rates on online credit?

A: Maintaining a good credit score, comparing offers from multiple lenders, and exploring options with lower interest rates can help mitigate high interest rates.

Q: What should I do if I cannot repay my online loan?

A: Contact the lender immediately to discuss your situation. They may offer options such as a temporary forbearance, payment plan, or debt consolidation.

Conclusion:

Online credit has become an integral part of modern financial management, offering convenience, accessibility, and flexibility. By understanding the benefits and considerations involved, individuals can navigate the online credit landscape effectively and leverage these options to achieve their financial goals. It is crucial to approach online credit with a discerning eye, carefully evaluating lenders, terms, and interest rates to ensure responsible borrowing and financial well-being.

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Online Credit: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!