Navigating the World of Financial Security: A Comprehensive Guide to Insurance

Related Articles: Navigating the World of Financial Security: A Comprehensive Guide to Insurance

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the World of Financial Security: A Comprehensive Guide to Insurance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Financial Security: A Comprehensive Guide to Insurance

Insurance, in its essence, is a financial instrument designed to mitigate risk. It operates on the principle of risk pooling, where a large number of individuals or entities contribute to a common fund. This fund is then used to compensate those who experience the insured event, such as an accident, illness, or property damage.

While the concept of insurance is straightforward, the various types and nuances can be overwhelming. This article aims to provide a comprehensive understanding of insurance, exploring its different forms, benefits, and considerations.

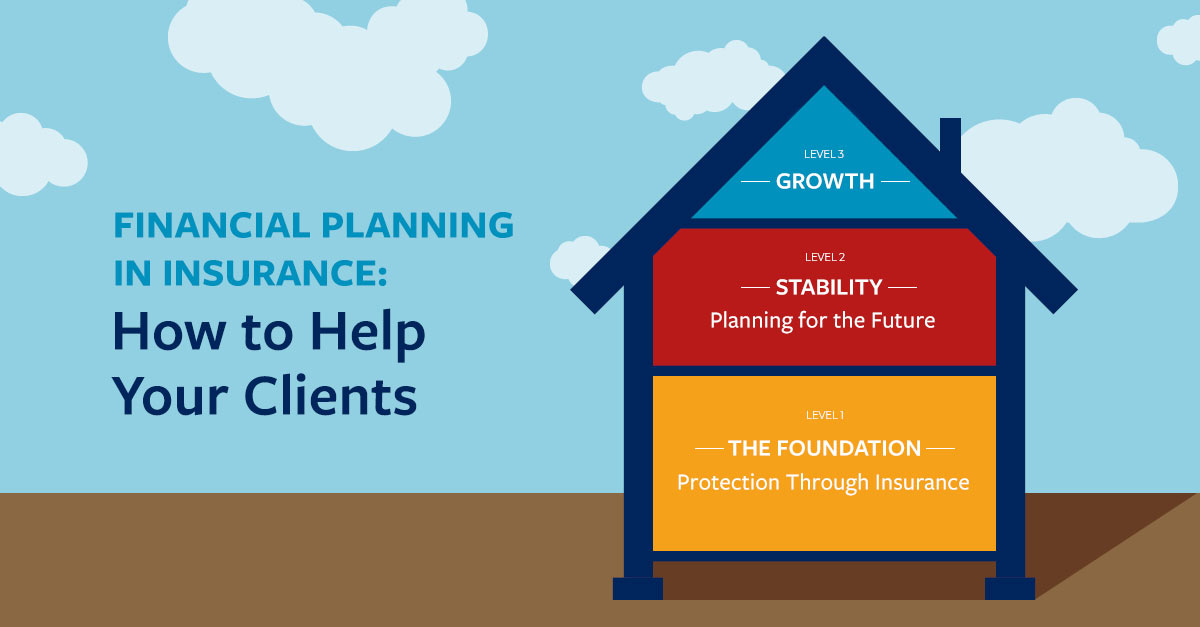

Understanding the Fundamentals

At its core, insurance is a contract between an insurer (the insurance company) and an insured (the individual or entity seeking coverage). The insured agrees to pay a premium (a regular fee) in exchange for the insurer’s promise to provide financial protection against a specified risk.

Types of Insurance

Insurance encompasses a wide range of coverage, catering to various needs and situations. Some of the most common types include:

- Life Insurance: Provides financial protection to beneficiaries upon the insured’s death. It ensures financial stability for dependents, covering expenses like funeral costs, outstanding debts, and income replacement.

- Health Insurance: Offers coverage for medical expenses incurred due to illness or injury. It can include hospitalization, surgery, medication, and preventive care.

- Property Insurance: Protects against financial losses resulting from damage or destruction to property. This includes homeowners insurance, renters insurance, and business insurance.

- Auto Insurance: Covers financial losses arising from accidents involving vehicles. It typically includes liability coverage for damage to other vehicles or property, as well as coverage for the insured vehicle and medical expenses.

- Disability Insurance: Provides income replacement for individuals who become unable to work due to illness or injury.

- Travel Insurance: Offers protection against unforeseen events during travel, such as medical emergencies, flight cancellations, and lost luggage.

The Importance of Insurance

Insurance plays a vital role in securing financial stability and mitigating potential risks. Its importance can be summarized as follows:

- Financial Protection: Insurance provides a financial safety net against unexpected events, preventing catastrophic financial losses that could cripple individuals or businesses.

- Peace of Mind: Knowing that insurance exists to cover potential risks allows individuals and businesses to focus on their goals and aspirations without constant worry.

- Legal Protection: Certain types of insurance, such as liability insurance, offer legal protection against lawsuits and claims arising from negligence or accidents.

- Risk Management: Insurance helps individuals and businesses manage risk by transferring the financial burden of potential losses to the insurer.

Choosing the Right Insurance

Selecting the appropriate insurance coverage involves careful consideration of individual circumstances, needs, and risk tolerance. The following factors are crucial:

- Risk Assessment: Identifying potential risks and their likelihood of occurring is essential.

- Coverage Needs: Evaluating the specific coverage required to address identified risks is crucial.

- Budget: Determining the affordability of insurance premiums and ensuring they align with financial resources is vital.

- Policy Comparison: Comparing policies from different insurers to find the best value for money is crucial.

Common Insurance FAQs

1. What is a deductible?

A deductible is the amount an insured must pay out-of-pocket before the insurance company begins covering claims.

2. What is a premium?

A premium is the regular payment made to the insurer in exchange for coverage.

3. What is a beneficiary?

A beneficiary is the person or entity designated to receive the insurance payout in the event of a claim.

4. What is a claim?

A claim is a request for compensation from the insurer for a covered loss.

5. What is a policy?

A policy is the written contract outlining the terms and conditions of the insurance agreement.

Tips for Effective Insurance Management

- Review your policies regularly: Ensure your coverage remains sufficient and aligned with your changing needs and circumstances.

- Understand your policy terms: Familiarize yourself with the coverage details, limitations, and exclusions.

- Keep accurate records: Maintain records of all policy documents, claims, and payments for easy reference.

- Shop around for better rates: Periodically compare quotes from different insurers to find competitive premiums.

- Consider additional coverage: Evaluate the need for supplemental insurance, such as umbrella insurance or flood insurance.

Conclusion

Insurance is an indispensable tool for navigating the uncertainties of life. By providing financial protection against unforeseen events, it empowers individuals and businesses to pursue their goals with confidence and peace of mind. Understanding the various types of insurance, assessing individual needs, and making informed decisions regarding coverage are key to maximizing the benefits of this essential financial instrument. By embracing the principles of insurance, individuals and businesses can build a strong foundation for financial security and resilience.

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Financial Security: A Comprehensive Guide to Insurance. We hope you find this article informative and beneficial. See you in our next article!