Navigating the Realm of Short-Term Loans: A Comprehensive Guide to Online Loan Applications

Related Articles: Navigating the Realm of Short-Term Loans: A Comprehensive Guide to Online Loan Applications

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Realm of Short-Term Loans: A Comprehensive Guide to Online Loan Applications. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Realm of Short-Term Loans: A Comprehensive Guide to Online Loan Applications

The landscape of personal finance has evolved significantly, with online platforms offering a plethora of financial services, including short-term loans. These services, often marketed as a convenient and accessible solution for urgent financial needs, have become increasingly popular. However, navigating this landscape requires a thorough understanding of the intricacies involved, particularly when considering online loan applications from companies like Check Into Cash.

This comprehensive guide delves into the process of applying for a loan online, focusing on Check Into Cash as a case study, to equip individuals with the knowledge necessary to make informed decisions.

Understanding Check Into Cash and Online Loan Applications

Check Into Cash, a prominent provider of short-term loans, has established a robust online presence, allowing individuals to apply for loans directly through their website. This digital approach offers several advantages, including:

- Convenience: Applying for a loan online eliminates the need for physical visits to a branch, saving time and effort.

- Accessibility: Online applications are available 24/7, providing flexibility and convenience to individuals with busy schedules.

- Transparency: Online platforms often provide clear and concise information about loan terms, interest rates, and fees, promoting transparency and informed decision-making.

- Speed: Online applications are typically processed faster than traditional loan applications, allowing individuals to access funds more quickly.

The Application Process: A Step-by-Step Guide

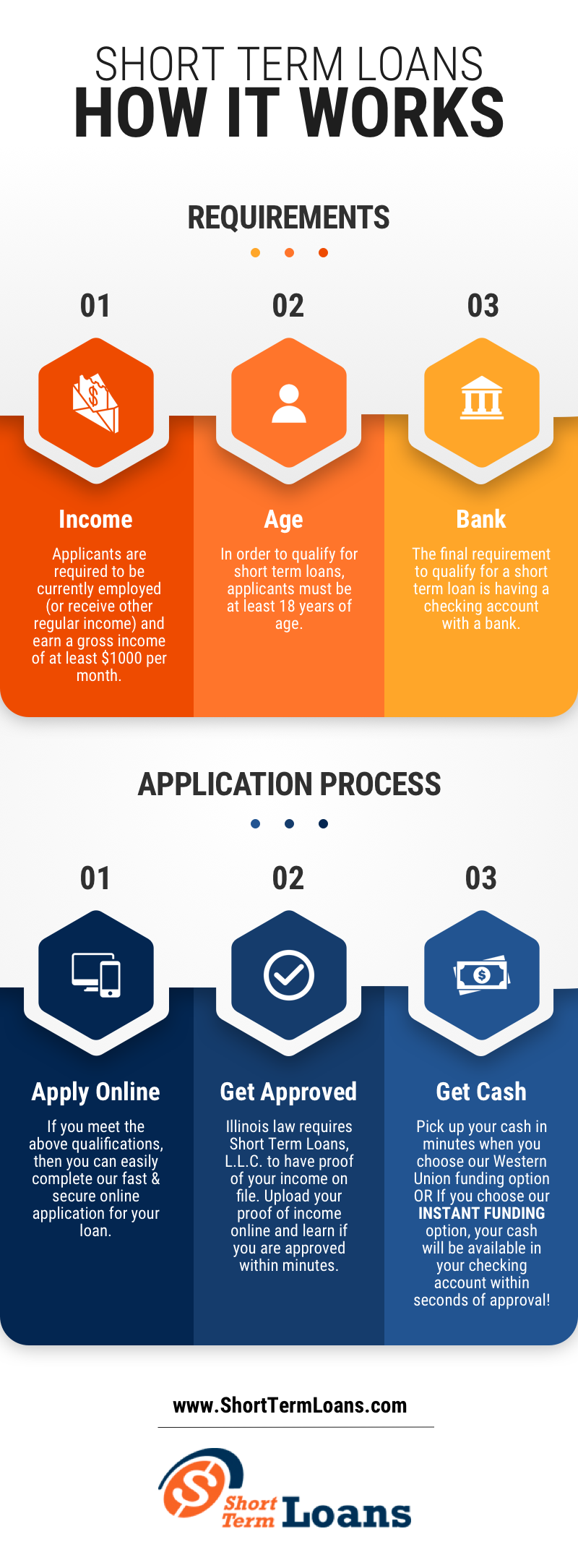

The application process for an online loan through Check Into Cash follows a structured and user-friendly approach:

- Visit the Website: Start by accessing the official Check Into Cash website.

- Select Loan Type: The website will present various loan options, each tailored to specific financial needs. Carefully review the details of each loan type to determine the most suitable option.

- Provide Personal Information: The application form will require basic personal information, including name, address, Social Security number, and contact details.

- Financial Information: Applicants are required to provide information regarding their income, employment status, and existing debt obligations.

- Verification: Check Into Cash may verify the provided information through credit checks and other means to assess creditworthiness.

- Review and Submit: Thoroughly review the loan terms, interest rates, and fees before submitting the application.

- Approval and Funding: Upon approval, funds are typically deposited into the applicant’s bank account within one business day.

Factors Influencing Loan Approval and Terms

The approval of an online loan application, as well as the associated terms, are influenced by several factors:

- Credit Score: A good credit score significantly increases the chances of loan approval and favorable terms. Individuals with lower credit scores may face higher interest rates or potentially be denied a loan.

- Income and Employment: Stable employment and sufficient income demonstrate the ability to repay the loan, improving approval prospects.

- Debt-to-Income Ratio: A high debt-to-income ratio (DTI) can negatively impact loan approval. Lenders prefer applicants with a lower DTI, indicating a manageable debt burden.

- Loan History: A positive loan history, characterized by timely repayments, can enhance approval chances and potentially lead to lower interest rates.

Key Considerations for Online Loan Applications

While online loan applications offer convenience, it is crucial to approach them with caution and due diligence:

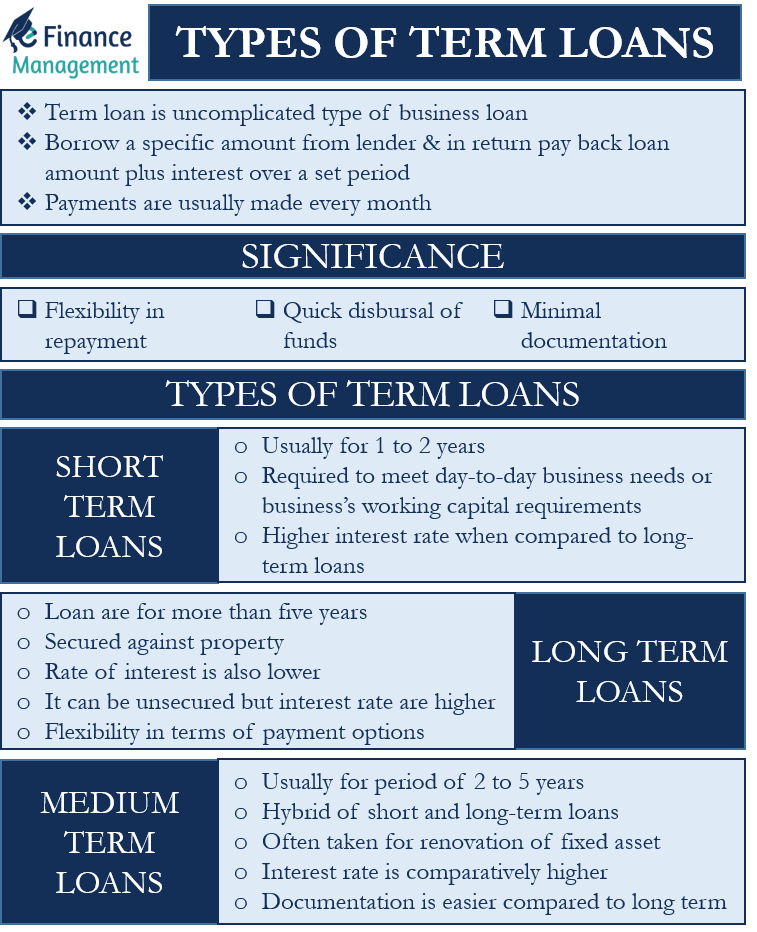

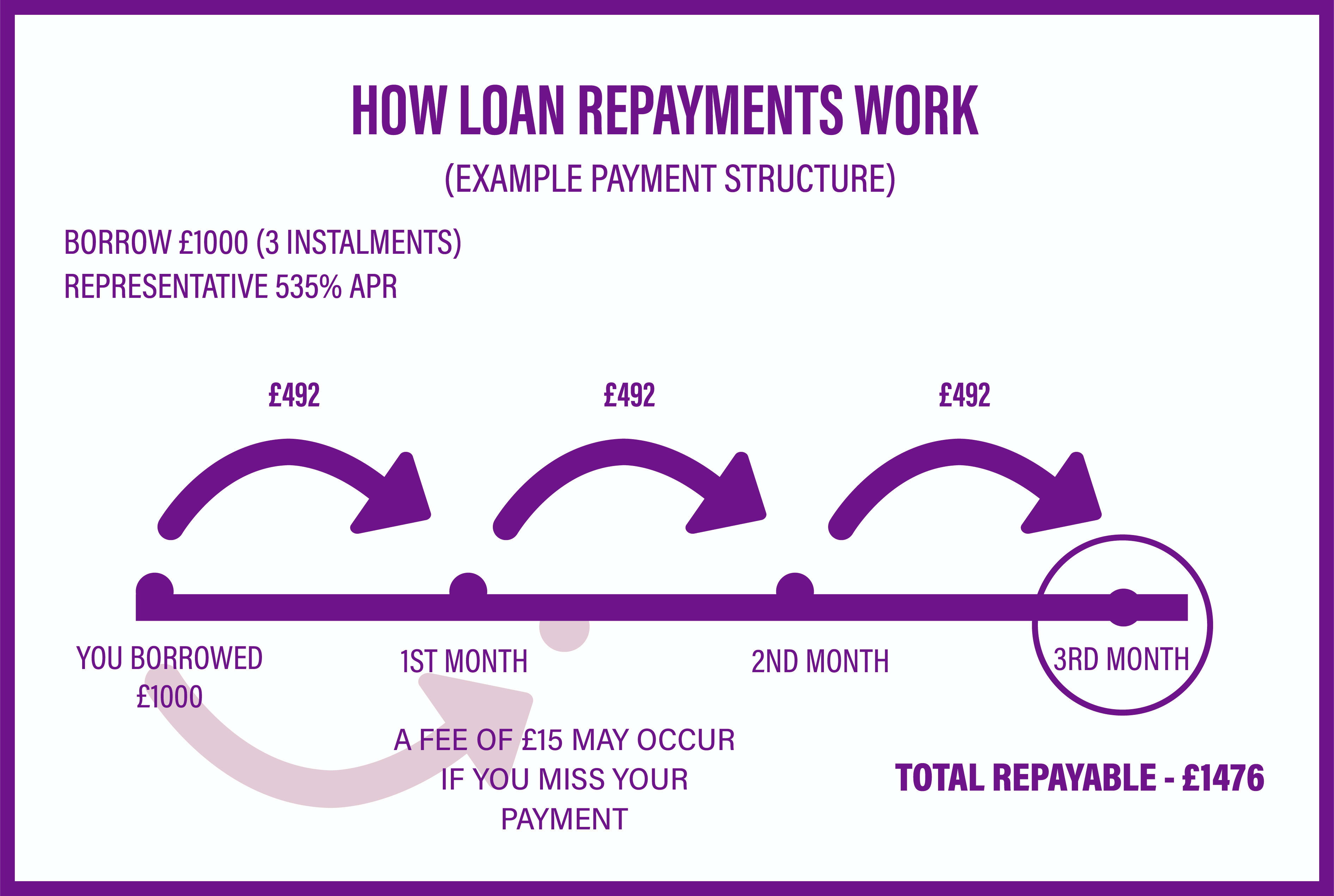

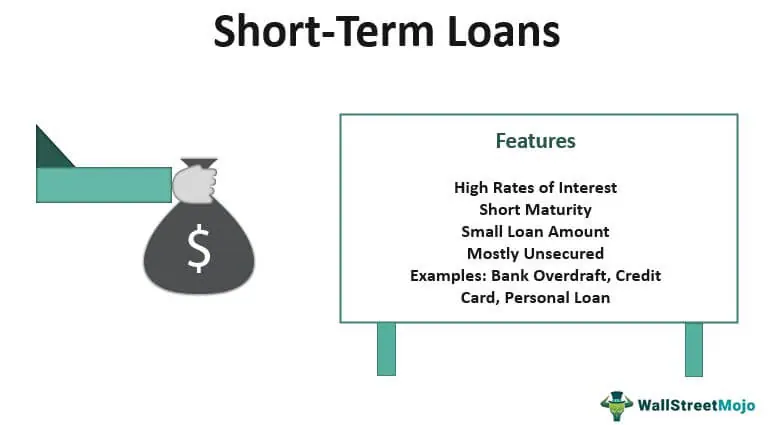

- Interest Rates and Fees: Online loans, particularly short-term ones, often carry high interest rates and fees. Carefully evaluate these costs to ensure they align with your financial capabilities.

- Loan Terms: Understand the loan duration, repayment schedule, and any associated penalties for late payments.

- Borrowing Responsibly: Avoid borrowing more than you can comfortably repay. Consider the potential impact on your budget and overall financial health.

- Alternative Options: Explore alternative financing options, such as personal loans from banks or credit unions, which may offer lower interest rates and longer repayment terms.

Frequently Asked Questions (FAQs) about Check Into Cash Online Loan Applications

1. What is the minimum credit score required for a Check Into Cash loan?

Check Into Cash does not publicly disclose a specific minimum credit score requirement. However, having a good credit score generally increases the chances of approval and potentially results in more favorable loan terms.

2. What are the typical loan amounts offered by Check Into Cash?

Loan amounts vary depending on individual circumstances and state regulations. Check Into Cash typically offers loans ranging from a few hundred dollars to a few thousand dollars.

3. How long does it take to receive the loan funds after approval?

Funds are typically deposited into the applicant’s bank account within one business day of approval.

4. Can I apply for a loan online if I have a bad credit history?

Check Into Cash does consider applicants with less-than-perfect credit histories. However, individuals with a history of financial difficulties may face higher interest rates or potentially be denied a loan.

5. What are the consequences of defaulting on a Check Into Cash loan?

Defaulting on a loan can have serious consequences, including:

- Negative impact on credit score: Late payments or defaults can damage your credit score, making it harder to obtain loans or credit in the future.

- Collection efforts: Check Into Cash may pursue collection efforts to recover the outstanding debt.

- Legal action: In some cases, legal action may be taken to recover the debt, potentially leading to wage garnishment or property seizure.

Tips for Successful Online Loan Applications

- Compare Loan Offers: Shop around for the best rates and terms before committing to a loan.

- Check Your Credit Score: Review your credit report for any errors and take steps to improve your score if needed.

- Maintain a Stable Income: Having a reliable source of income demonstrates your ability to repay the loan.

- Budget Carefully: Create a realistic budget to ensure you can afford the loan payments without straining your finances.

- Read the Fine Print: Thoroughly review all loan documents, including the interest rates, fees, and repayment terms, before signing anything.

Conclusion: Responsible Borrowing and Financial Wellness

Online loan applications, while offering convenience and accessibility, require careful consideration and responsible borrowing practices. Understanding the intricacies of the application process, the factors influencing loan approval and terms, and the potential consequences of defaulting are essential for making informed financial decisions.

When seeking short-term loans, it is vital to explore all available options, compare rates and terms, and consider the potential impact on your financial well-being. Ultimately, responsible borrowing practices contribute to long-term financial stability and peace of mind.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Realm of Short-Term Loans: A Comprehensive Guide to Online Loan Applications. We appreciate your attention to our article. See you in our next article!