Navigating the Path to Online Education: Financial Aid and Resources for Students

Related Articles: Navigating the Path to Online Education: Financial Aid and Resources for Students

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Path to Online Education: Financial Aid and Resources for Students. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Online Education: Financial Aid and Resources for Students

The pursuit of higher education is a significant investment, and the financial burden can be daunting. However, with the rise of online learning, accessibility and affordability have become increasingly intertwined. This article will delve into the realm of financial aid and resources available to students seeking an online education, offering a comprehensive guide to navigate the complexities of funding a college degree.

Understanding the Landscape of Online Education:

Online learning has revolutionized higher education, offering flexibility and convenience to students of all backgrounds. It allows individuals to pursue degrees while balancing work, family, or other commitments. However, the financial aspect remains a crucial consideration.

Exploring Financial Aid Options:

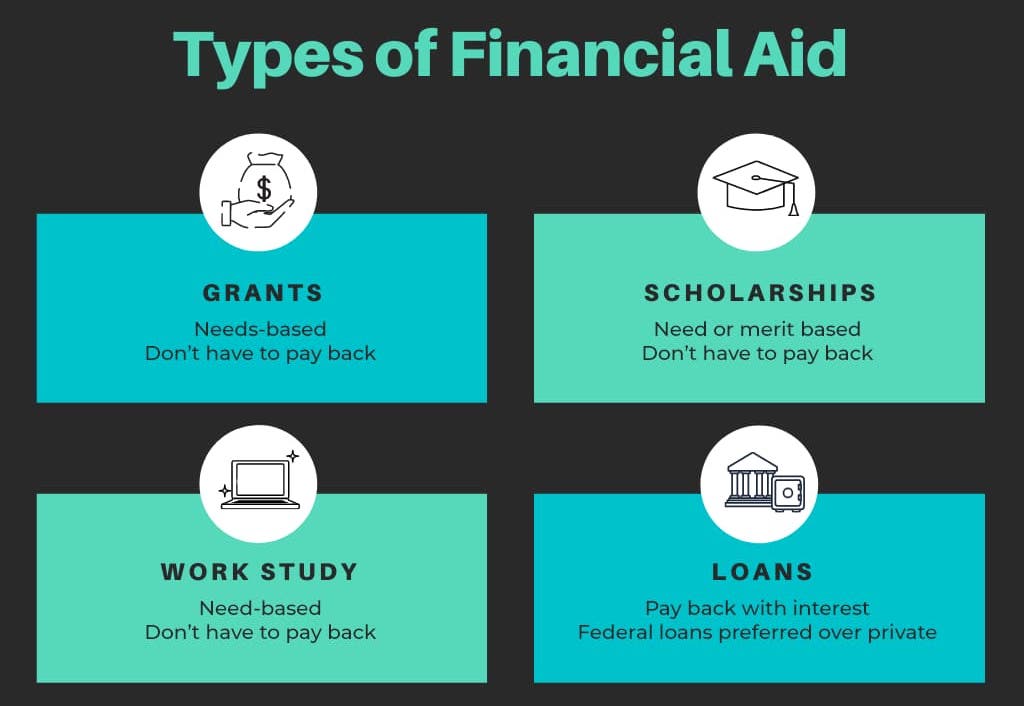

Several avenues exist to fund an online education:

- Federal Grants: These are need-based grants that do not require repayment. The Federal Pell Grant and the Federal Supplemental Educational Opportunity Grant (SEOG) are prominent examples.

- Federal Loans: These are low-interest loans that require repayment after graduation. Federal Direct Loans, including subsidized and unsubsidized loans, are available to eligible students.

- State Grants: Many states offer need-based grants to residents pursuing higher education within their state.

- Institutional Aid: Colleges and universities often provide scholarships, grants, and other forms of financial aid to students based on academic merit, financial need, or specific criteria.

- Private Loans: While these loans often have higher interest rates than federal loans, they can be an option for students who do not qualify for sufficient federal aid.

- Scholarships: Numerous scholarships are available from private organizations, foundations, and corporations. These can be awarded based on academic achievement, community involvement, or specific fields of study.

- Employer Tuition Assistance: Some employers offer tuition reimbursement or assistance programs to employees pursuing higher education.

Maximizing Financial Aid Opportunities:

- FAFSA (Free Application for Federal Student Aid): This application is the cornerstone of federal financial aid. Completing the FAFSA is crucial for accessing grants, loans, and work-study opportunities.

- CSS Profile: Some colleges and universities use this application in addition to the FAFSA to determine eligibility for institutional aid.

- Scholarship Search Engines: Numerous online resources, such as Scholly, Fastweb, and Scholarships.com, allow students to search for scholarships based on various criteria.

- Networking: Building connections with professionals in your field can lead to scholarship opportunities or employer tuition assistance programs.

- Financial Aid Office: Reach out to the financial aid office at your chosen online institution for personalized guidance and assistance with navigating the financial aid process.

Beyond Financial Aid: Other Cost-Saving Strategies:

- Choosing Affordable Programs: Some online programs are more cost-effective than others. Research program costs and compare them across different institutions.

- Earning Credits Through Prior Learning: Many colleges offer credit for prior learning, including work experience, military service, or previous college coursework.

- Taking Advantage of Free Resources: Numerous free online resources are available for learning, such as MOOCs (Massive Open Online Courses) offered by platforms like Coursera, edX, and Udacity.

Addressing Common Concerns:

- Is online education as valuable as traditional education? Online degrees are increasingly recognized and valued by employers. However, it’s crucial to choose accredited programs from reputable institutions.

- Are online programs less rigorous? Reputable online programs maintain rigorous academic standards comparable to traditional programs.

- Do online programs offer the same networking opportunities? Online programs often provide opportunities for online networking through forums, chat rooms, and virtual events.

Tips for Success:

- Set Clear Goals: Define your educational objectives and choose a program that aligns with your career aspirations.

- Develop Strong Time Management Skills: Online learning requires self-discipline and effective time management to balance studies with other responsibilities.

- Seek Support: Connect with classmates, faculty, and online learning support services for assistance and motivation.

- Stay Organized: Create a dedicated workspace and maintain a consistent study schedule.

- Embrace Technology: Familiarize yourself with online learning platforms and tools.

Conclusion:

Pursuing an online degree can be a financially viable path to achieving educational goals. By understanding the available financial aid options, exploring cost-saving strategies, and embracing a proactive approach, students can navigate the financial complexities of online education and unlock opportunities for personal and professional growth.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Online Education: Financial Aid and Resources for Students. We hope you find this article informative and beneficial. See you in our next article!