Navigating the Online Landscape of Short-Term Financial Solutions: A Comprehensive Guide to Check Into Cash

Related Articles: Navigating the Online Landscape of Short-Term Financial Solutions: A Comprehensive Guide to Check Into Cash

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Online Landscape of Short-Term Financial Solutions: A Comprehensive Guide to Check Into Cash. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Online Landscape of Short-Term Financial Solutions: A Comprehensive Guide to Check Into Cash

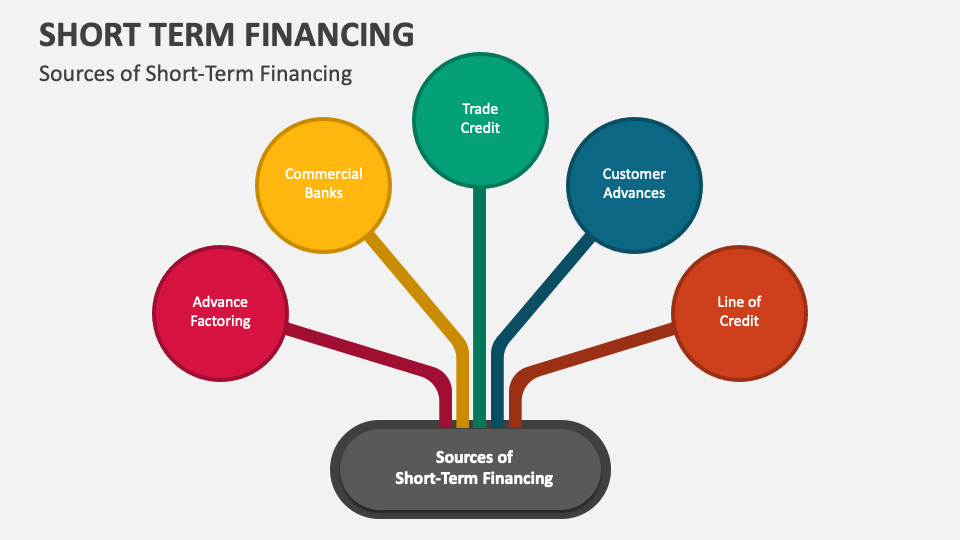

In the contemporary financial landscape, individuals often encounter unexpected expenses or unforeseen financial emergencies. While traditional banking institutions may offer a range of financial products, they can sometimes be slow or inflexible in responding to immediate needs. This is where alternative financial service providers, such as Check Into Cash, can play a crucial role, offering readily accessible short-term financial solutions.

This article aims to provide a comprehensive overview of the online application process for short-term financial products offered by Check Into Cash, emphasizing its ease of access, transparency, and the potential benefits it offers to individuals facing temporary financial challenges.

Understanding Check Into Cash and its Online Application Process:

Check Into Cash is a leading provider of short-term financial products, including payday loans, installment loans, and other financial services. The company operates a nationwide network of physical locations, but its online platform offers an alternative, convenient channel for accessing financial assistance.

The Online Application Process:

Applying for a loan online through Check Into Cash is a straightforward and user-friendly experience. The process typically involves the following steps:

- Visit the Check Into Cash Website: Access the company’s official website, which is designed with a clear and intuitive interface.

- Select the Desired Loan Product: Explore the range of loan products offered, including payday loans, installment loans, or other financial services, carefully considering the terms and conditions of each option.

- Provide Personal Information: The online application form will request basic personal information, such as name, address, Social Security number, and contact details.

- Submit Financial Information: You will be required to provide information about your income, employment history, and banking details. This information is used to assess your creditworthiness and determine the loan amount you qualify for.

- Review and Submit the Application: Carefully review the terms and conditions of the loan agreement before submitting your application.

- Verification and Approval: Check Into Cash reviews applications promptly. Once approved, the loan funds are typically deposited directly into your bank account within one business day.

Benefits of Applying for Short-Term Financial Products Online:

There are numerous advantages to applying for short-term financial products online, including:

- Convenience: The online application process is available 24/7, allowing individuals to apply for a loan at their convenience, without the need to visit a physical location.

- Speed: Online applications are typically processed faster than traditional loan applications, with funds often being deposited into your bank account within one business day.

- Transparency: The online application process provides clear and concise information about the loan terms, interest rates, and repayment schedule, ensuring transparency and minimizing confusion.

- Privacy: Applying online offers a greater degree of privacy, as you do not need to physically interact with a loan officer or visit a physical location.

Considerations for Choosing Online Short-Term Loans:

While online short-term loans can provide a convenient and quick solution to financial emergencies, it’s crucial to consider the following factors:

- Interest Rates: Short-term loans typically come with higher interest rates compared to traditional loans. Carefully evaluate the interest rate and ensure you can afford the repayment schedule.

- Fees: Pay attention to any associated fees, such as origination fees, late payment fees, or other charges, as these can add to the overall cost of the loan.

- Repayment Schedule: Understand the loan repayment terms, including the duration of the loan and the frequency of payments.

- Credit Impact: While short-term loans may not significantly impact your credit score, it’s advisable to check the lender’s credit reporting practices.

FAQs about Check Into Cash and Online Applications:

Q: What are the eligibility requirements for applying for a loan online with Check Into Cash?

A: Eligibility requirements vary depending on the specific loan product you are applying for. Generally, you must be at least 18 years old, have a valid Social Security number, a checking account in good standing, and meet certain income requirements.

Q: How secure is the online application process?

A: Check Into Cash utilizes industry-standard encryption technology to protect your personal and financial information during the online application process, ensuring a secure and confidential experience.

Q: What happens if my loan application is denied?

A: If your loan application is denied, Check Into Cash will typically provide an explanation for the denial, such as insufficient income or poor credit history. You may have the option to appeal the decision or explore other loan products offered by Check Into Cash.

Q: What are the consequences of not repaying my loan on time?

A: Failure to repay your loan on time can result in late fees, penalties, and potentially negative impacts on your credit score. It’s crucial to adhere to the repayment schedule outlined in your loan agreement.

Tips for Applying for a Short-Term Loan Online:

- Compare Loan Options: Before applying for a loan, compare interest rates, fees, and terms from multiple lenders to find the most favorable option.

- Check Your Credit Score: Reviewing your credit score can help you understand your creditworthiness and identify any potential issues that may affect your loan application.

- Budget Carefully: Ensure you can afford the loan repayments before applying. Create a budget that includes the loan payment and other expenses.

- Read the Fine Print: Carefully review the loan agreement, including the interest rate, fees, and repayment terms, before submitting your application.

Conclusion:

Check Into Cash provides a convenient and readily accessible online platform for individuals seeking short-term financial solutions. By offering a user-friendly application process, transparent terms, and prompt funding, Check Into Cash empowers individuals to address unexpected expenses or financial emergencies. However, it’s crucial to approach short-term loans with a responsible mindset, carefully considering the interest rates, fees, and repayment schedule before making a decision. By understanding the intricacies of online loan applications and exercising financial prudence, individuals can navigate the landscape of short-term financial products with confidence and secure the financial assistance they need in times of need.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Online Landscape of Short-Term Financial Solutions: A Comprehensive Guide to Check Into Cash. We thank you for taking the time to read this article. See you in our next article!