A Comprehensive Look at the Financial Services Industry: Exploring the Role of Check Cashing Businesses

Related Articles: A Comprehensive Look at the Financial Services Industry: Exploring the Role of Check Cashing Businesses

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to A Comprehensive Look at the Financial Services Industry: Exploring the Role of Check Cashing Businesses. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

A Comprehensive Look at the Financial Services Industry: Exploring the Role of Check Cashing Businesses

The financial services industry is a vast and complex landscape, encompassing a diverse range of institutions and services that cater to the financial needs of individuals and businesses. Within this landscape, check cashing businesses play a crucial role, providing essential financial services to a significant portion of the population.

Understanding the Role of Check Cashing Businesses

Check cashing businesses, also known as payday lenders or cash advance providers, offer a variety of financial services, primarily focused on cash transactions. These services include:

- Check cashing: This is the core service offered, allowing individuals to convert checks into cash for a fee.

- Money orders: Providing a secure and reliable way to send money domestically or internationally.

- Bill pay: Facilitating the payment of bills, including utilities, rent, and other recurring expenses.

- Prepaid debit cards: Offering a convenient and accessible alternative to traditional bank accounts.

- Short-term loans: Providing small, short-term loans to individuals facing temporary financial hardship.

The Target Audience and the Importance of These Services

These services are particularly valuable for individuals who lack access to traditional banking services, often referred to as the "unbanked" or "underbanked." This group may include those with low income, poor credit history, or limited financial literacy. The unbanked population faces significant barriers to traditional financial products and services, such as high minimum balances, strict credit requirements, and complex procedures.

Check cashing businesses provide a vital lifeline for these individuals, offering a readily available and accessible alternative to traditional banking. They enable access to cash for essential needs, facilitate bill payments, and provide a means to manage finances in the absence of a traditional bank account.

Addressing Concerns and Misconceptions

While check cashing businesses play a crucial role in providing financial services to underserved populations, they have also been subject to criticism and concerns. These concerns often revolve around:

- High fees: Check cashing businesses charge fees for their services, which can be perceived as exorbitant by some. It is important to note that these fees are often justified by the costs associated with providing these services, including the risk of bad checks, fraud, and regulatory compliance.

- Predatory lending practices: Some check cashing businesses offer short-term loans with high interest rates, which can trap borrowers in a cycle of debt. It is crucial for consumers to understand the terms and conditions of these loans and to borrow responsibly.

- Lack of financial education: Some argue that check cashing businesses contribute to financial instability by encouraging reliance on short-term solutions rather than promoting financial literacy and long-term financial planning.

Addressing these concerns requires a multifaceted approach:

- Increased transparency and consumer education: It is essential to provide consumers with clear and accessible information about the fees and terms associated with check cashing services.

- Responsible lending practices: Regulators and industry stakeholders must work together to ensure that lending practices are fair and transparent, and that borrowers are protected from predatory lending.

- Promoting financial literacy: Efforts should be made to promote financial literacy among underserved populations, equipping them with the knowledge and skills necessary to make informed financial decisions.

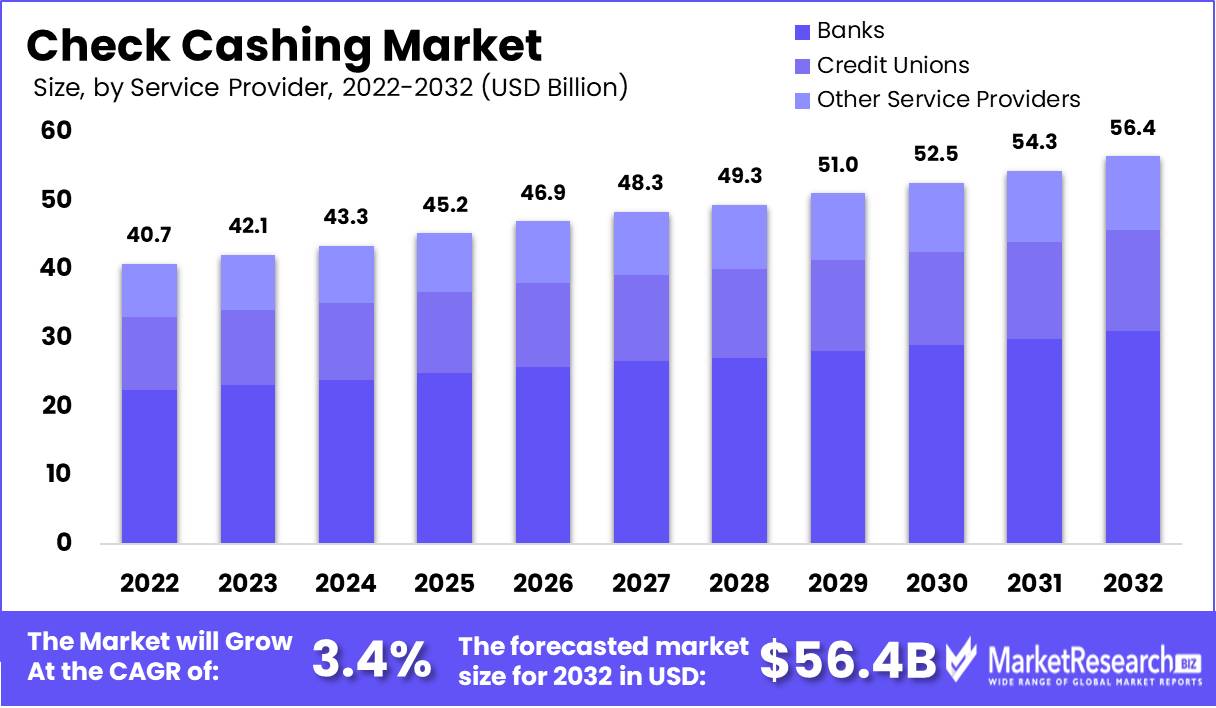

The Future of Check Cashing Businesses

The future of check cashing businesses will likely be shaped by several factors:

- Technological advancements: The increasing adoption of digital technologies, such as mobile banking and online payments, may impact the demand for traditional check cashing services.

- Regulatory changes: Regulatory changes, such as stricter lending regulations and consumer protection measures, will continue to influence the operations of check cashing businesses.

- Shifting consumer preferences: As consumers become more financially savvy and have access to a wider range of financial products and services, their preferences will likely evolve, impacting the demand for check cashing services.

FAQs on Check Cashing Businesses

1. What types of checks can I cash at a check cashing business?

Check cashing businesses typically accept various types of checks, including payroll checks, government checks, tax refund checks, and personal checks. However, they may have specific requirements and limitations regarding the acceptance of checks.

2. What are the fees associated with check cashing services?

Fees vary depending on the check amount, the type of check, and the specific check cashing business. It is important to inquire about the fee structure before cashing a check.

3. Are check cashing businesses safe?

Reputable check cashing businesses are generally safe, but it is crucial to choose a licensed and regulated business. It is also advisable to avoid cashing checks from unknown sources or individuals.

4. What are the advantages of using a check cashing business?

Check cashing businesses offer convenience, accessibility, and speed. They can be particularly helpful for individuals who lack access to traditional banking services.

5. What are the disadvantages of using a check cashing business?

The main disadvantage is the high fees associated with their services. Additionally, some businesses may engage in predatory lending practices, offering high-interest loans that can trap borrowers in a cycle of debt.

Tips for Using Check Cashing Businesses

- Compare fees: Inquire about fees at different check cashing businesses before making a decision.

- Choose a licensed and regulated business: Ensure that the business is licensed and operates in compliance with all applicable regulations.

- Read the terms and conditions: Carefully review the terms and conditions of any services before using them.

- Be cautious of predatory lending: Avoid taking out loans with excessively high interest rates or fees.

- Consider alternative financial services: Explore other financial options, such as prepaid debit cards or online banking services, that may offer lower fees and more favorable terms.

Conclusion

Check cashing businesses play a vital role in providing financial services to underserved populations, offering a lifeline for individuals who lack access to traditional banking. However, it is important to address the concerns surrounding their operations, including high fees and potential predatory lending practices. By promoting transparency, responsible lending, and financial literacy, we can ensure that check cashing businesses operate ethically and effectively, providing essential financial services while empowering consumers to make informed financial decisions.

Closure

Thus, we hope this article has provided valuable insights into A Comprehensive Look at the Financial Services Industry: Exploring the Role of Check Cashing Businesses. We hope you find this article informative and beneficial. See you in our next article!